bain capital tech opportunities fund ii lp

Setter Capital is the global leader in liquidity solutions for private fund managers and institutional investors in alternative investments. Below is a list of notable private-equity firms.

Axtria Secures 150 Million Growth Investment From Bain Capital Tech Opportunities

Private Equity Internationals database of global private equity LP GP and fund profiles is continually updated by our expert team.

. Start your search now. Saama Capital is the same team with the same. Saama Capital II is an India-focused venture capital fund and is the independent successor fund to SVB India Capital Partners I SICP.

The team is similarly broad with practice head Richard. More on skills below. Our clients are some of the worlds leading fund sponsors pensions endowments and investment consultants.

Bain Capital LP is one of the worlds leading private multi-asset alternative investment firms with approximately 155 billion of assets under management that creates lasting impact for our investors teams businesses and the communities in which we live. See all stocks listed on NYSE for technology stocks oil and gas stocks consumber goods stocks. Since our inception in 2006 we have completed hundreds of transactions representing more.

Appian Capital Advisory LLP is the investment advisor to Appian Natural Resources Fund I LP and Appian Natural Resources Fund II LP two private equity funds that invest solely in mining or mining related companies assets and management teams across select geographies and commodities. NYSE Stocks Directory Full Listings list of public companies on the New York Stock Exchange. Since our founding in 1984 weve applied our insight and experience to organically expand into.

Kirkland Ellis International LLP has a broad funds offering advising major fund managers on fund formation and operational issues across both the upper and lower mid-market private equity space as well as advising credit and infrastructure funds. SICP has been successfully investing in Indian companies since 2006 following a collaborative partner driven approach with diversification across stage and sector. It also works with a solid share of the European private funds market.

BayPine led by former Silver Lake and Blackstone executives secured more than 15 billion for a debut buyout offering amid record tech fundraising in the North American market. The amount raised by BayPine Capital Partners Fund I and a sidecar vehicle was disclosed in Form D documents recently filed by the Boston private equity firm.

Bain Capital Targets 1 5 Billion For Second Tech Opportunities Fund

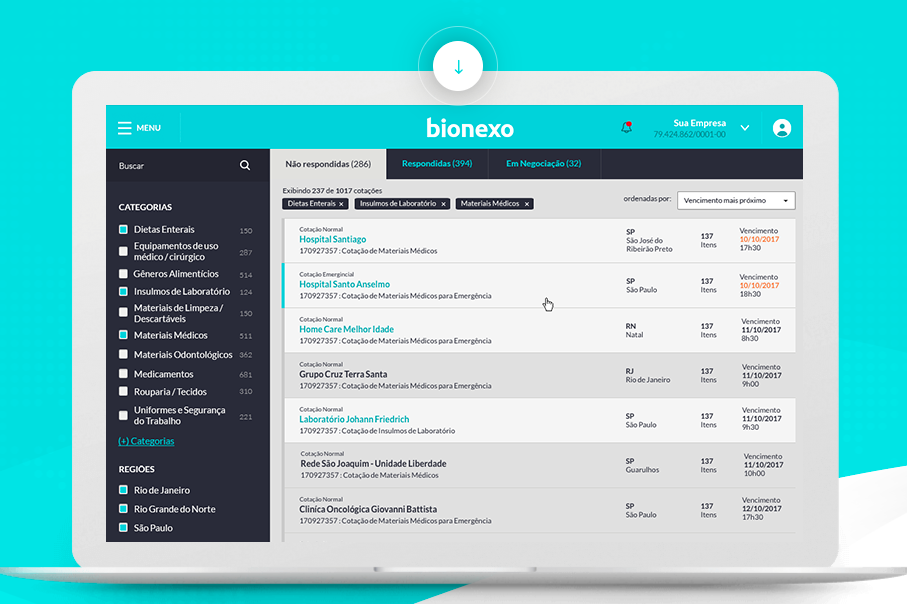

Bionexo Announces R 450 Million Investment From Bain Capital Tech Opportunities Bain Capital

Bain Capital Tech Opportunities Crunchbase Investor Profile Investments

Bain Capital Hits Target For Tech Fund With Nearly 1 1bn Plans To Keep Raising Buyouts

Our People Bain Capital Tech Opportunities

Pe Fundraising Scorecard Aea Bain Capital General Atlantic L Squared

Bain Capital Raises Usd 1 1bn So Far For Technology Private Equity Fund

Bain Capital Ventures Raises 1 3 Billion To Partner With Early Stage Entrepreneurs

Bain Capital Private Equity Leads Newlink S 200 Million Fundraising Bain Capital