capital gains tax canada real estate

The current rate of tax payable by an estate on any. Below are the federal tax brackets for 2022 which can give you an idea of how much tax you may.

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

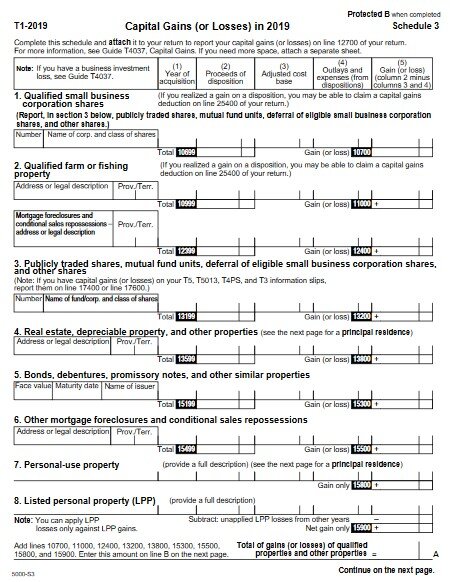

. Deferring the Capital Gain on Real Estate in Canada. If you sell a property for more than you bought it for you will be taxed on 50 of the difference in value. The adjusted cost base ACB the outlays and expenses incurred to sell your.

Ontario 3 potential taxes Land transfer tax Provincial. You must report the sale on. You realize a capital gain when you sell a capital asset and the proceeds of disposition exceeds the adjusted cost base.

Capital gains realized by a US. Sale of Canadian Real Estate. Your tax bracket which is determined by your total US.

If you sold real estate property in Canada but the proceeds will be received in installments over a period of time. All of Canadas tax treaties permit Canada to tax gains on direct interests in Canadian real estate that are owned by non-residents 6. If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

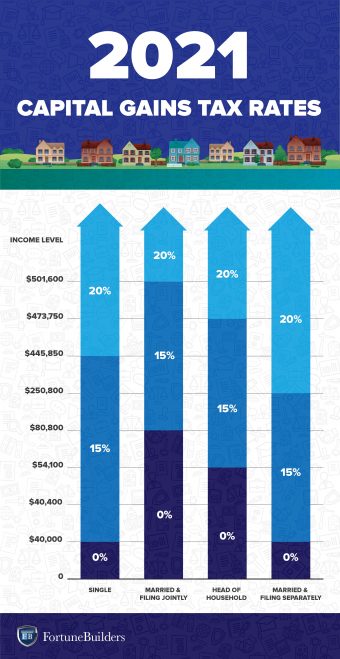

Real estate includes the following. When you sell your home you may realize a capital gain. Income as well as your filing category ie single married filing jointly or head of household.

Person on the sale of any Canadian real property interest regardless if it has been rented will attract Canadian and US tax. You pay this tax one time when you purchase a property in Ontario. The tax liability for capital gains in real estate is determined by the difference between the propertys cost basis and the sale price.

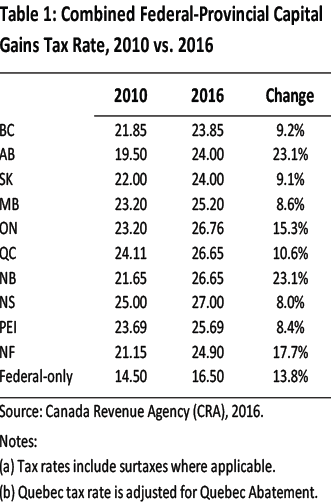

Capital gains are taxed as part of your income on your personal tax return. How to Reduce Your Capital Gains Tax in Canada on Real Estate. Capital Gains Tax in Canada.

You must pay taxes on 50 of this gain at your marginal tax rate. When you sell a capital property for more than you paid for it this is called a capital gain. In Canada 50 of the value of any capital gains are taxable.

The current rate of tax payable by an estate on any chargeable capital gains other than residential property is 20. Line 12700 - Taxable capital gains. Your tax rate is 20 on long.

Principal residence and other real estate. 05 of the value up to and including. Though the inclusion rate is the same for everyone there are certain ways to lower the amount of tax on.

To calculate your capital gain or loss you need to know the following 3 amounts. Ad Browse Discover Thousands of Business Investing Book Titles for Less. The proceeds of disposition.

Under the Act 50 of capital gains are included in income. Rental property both land and buildings farm property including both land and buildings other than qualified farm or fishing. When an inheritance occurs capital gains.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or.

Canada Capital Gains Tax Calculator 2022

How To Calculate Capital Gains Tax H R Block

Savings And Investment Oecd Capital Gains Tax Retirement Accounts

New Tax Rules For Canadian Controlled Private Corporations Madan Ca

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax In Canada Explained

How Much Tax Will I Pay If I Flip A House New Silver

Tax Profit As Income Or Capital Gains

Interest Rate Hikes Capital Gains Tax Better Immigration Could Blunt Canada S Housing Market Says Report Victoria Times Colonist

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

/TermDefinitions_Capitalgain_finalv1-b039981b63214a4692683b5f10661a01.png)

Capital Gains Definition Rules Taxes And Asset Types

Do You Pay Capital Gains Taxes On Property You Inherit

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Real Estate Capital Gains Tax Rates In 2021 2022

Tax Law For Selling Real Estate Turbotax Tax Tips Videos

Pay Less Tax On Your Capital Gains The Independent Dollar

Avoid Capital Gains Tax In Canada In 2022 Finder Canada

Personal Income Taxes And The Capital Gains Tax Fraser Institute

How To Avoid The Capital Gains Tax On Rental Property In Canada